Can Abiomed sustain its impressive sales growth in FY 2019?

by Kenny Dolgin, Data Insights, Guidepoint

Abiomed, Inc. (NYSE: ABMD) is a leader in the percutaneous heart pump device market, having launched its first Impella device in 2008 and have since released four iterations with varying flow rates. From May 2013 to May 2018, Abiomed’s stock price delivered a 5-year CAGR of 75%, making it one of the top performing stocks in the medical device space over that period.

In early 2018, Impella received an expanded FDA indication for use in both cardiomyopathy with cardiogenic shock and high risk percutaneous coronary intervention (PCI) procedures. Given favorable market dynamics, some analysts believe that Abiomed should be able to continue its penetration into its current $5 billion U.S. addressable market.

Factoring in these catalysts, how can investors track Abiomed’s ability to sustain its exceptionally high rate of growth?

Guidepoint’s Qsight is the answer.

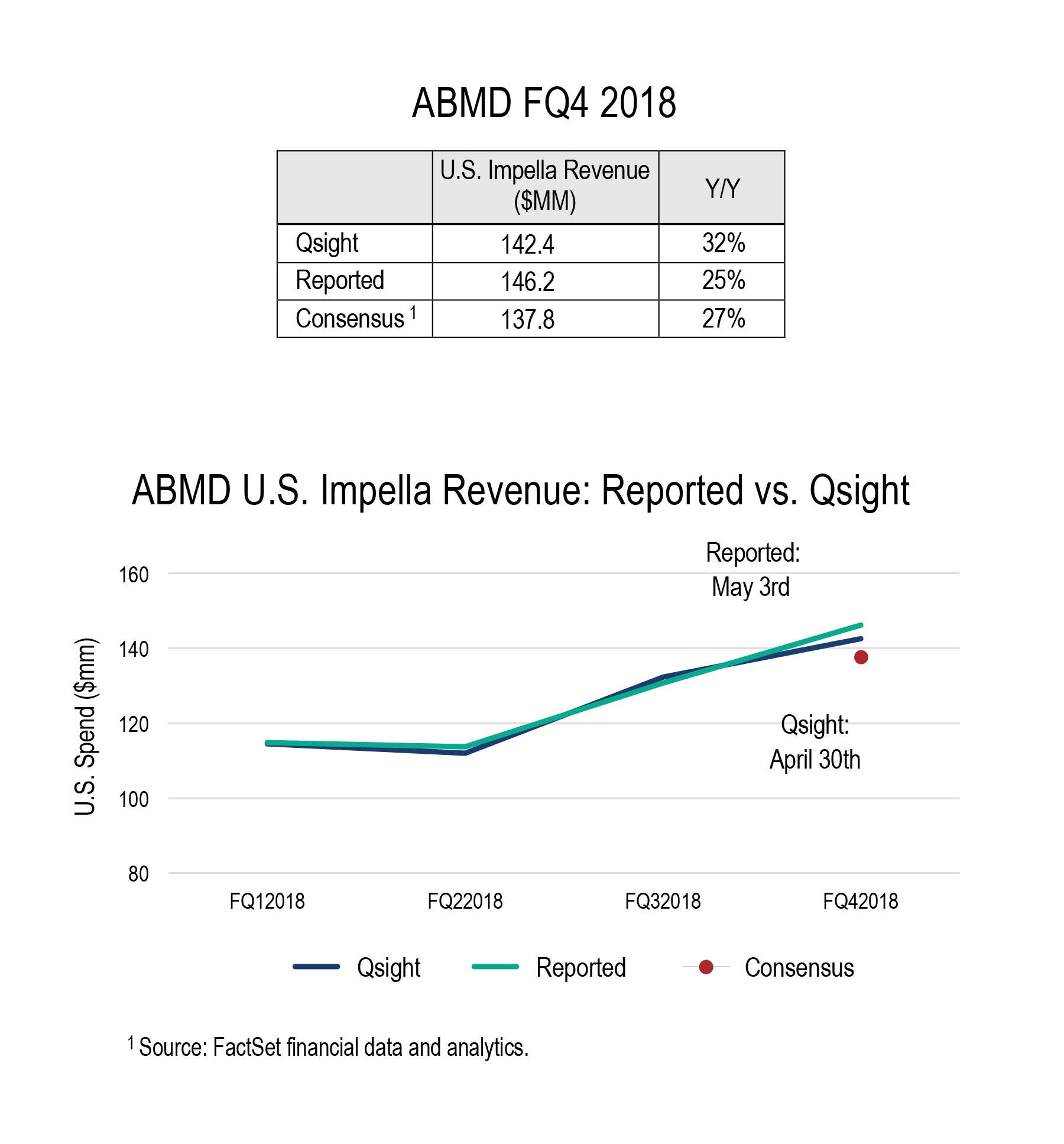

Guidepoint Qsight provides U.S. hospital purchasing data, which tracks monthly purchasing of over 1,500 hospitals in near real-time. Prior to ABMD’s fiscal Q4 2018 earnings release, Qsight’s data and projection methodology showed potential for their U.S. Impella revenues to come in above sell-side consensus estimates. On May 3rd, ABMD’s fiscal Q4 2018 U.S. Impella reported sales outperformed Street expectations, sending the stock price soaring 11% that day.

As an existing or potential shareholder in Abiomed, why would you not want access to real-time data on its key products and growth?

About Guidepoint Qsight Healthcare

Guidepoint Qsight Healthcare provides a multi-dimensional, quantitative view that tracks company performance in the healthcare industry. By leveraging the power of proprietary industry data along with Guidepoint TRACKER’s primary data, Guidepoint can provide a level of insight into market dynamics not found anywhere else. With additional data added over time, this innovative new approach provides high-valued, coverage-driven insights for investment clients.

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. The information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.