Can Edwards Lifesciences Fend Off Medtronic?

by Kenny Dolgin, Data Insights, Guidepoint

Edwards Lifesciences Corp. (NYSE: EW) is a leader in the approximately $3 billion transcatheter heart valve (THV) market, having launched their first SAPIEN valve in the U.S. in 2011 and now having released their third generation valve. From 2013 to 2017, Edwards’ stock price delivered a 5-year CAGR of 27%, making it one of the top performing names in the medical device space over that period.

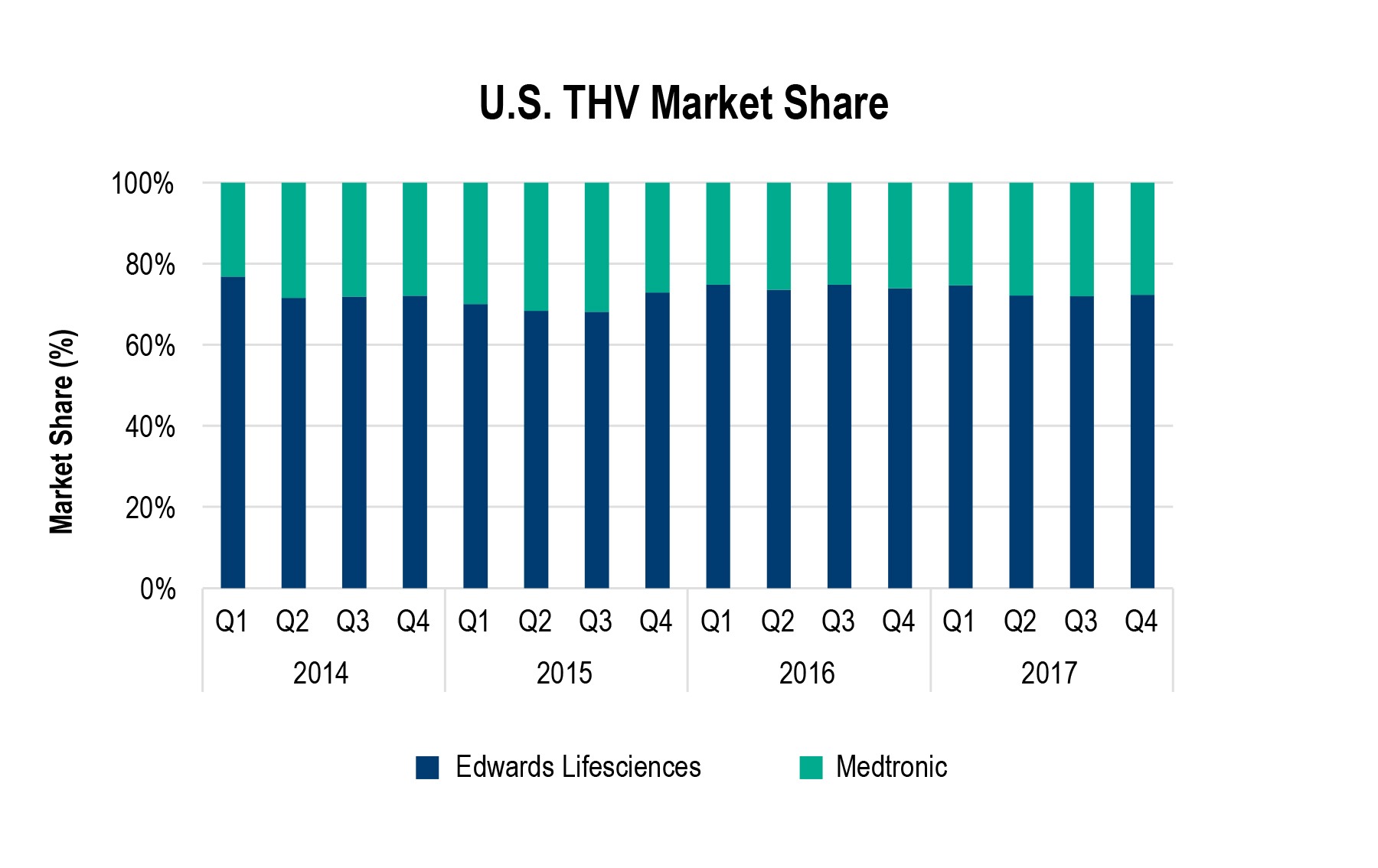

In 2017, Edwards exited with approximately 71% share in the U.S. THV market with Medtronic making up the other 29%. Edwards’ management expects to maintain their U.S. share in 2018 as they await the launch of their SAPIEN 3 Ultra and CENTERA valves in late 2018, as well as the release of the PARTNER III trial results in March 2019.

However, analysts have raised questions about the company’s ability to maintain share in the face of strong sales from Medtronic’s Evolut PRO valve, especially given the lack of near-term product launches for Edwards.

With these concerns regarding Edwards’ growth, how can investors assess the impact of competition from Medtronic, and potentially Boston Scientific, while awaiting the results of the PARTNER III trial in early 2019?

Guidepoint Qsight is the answer.

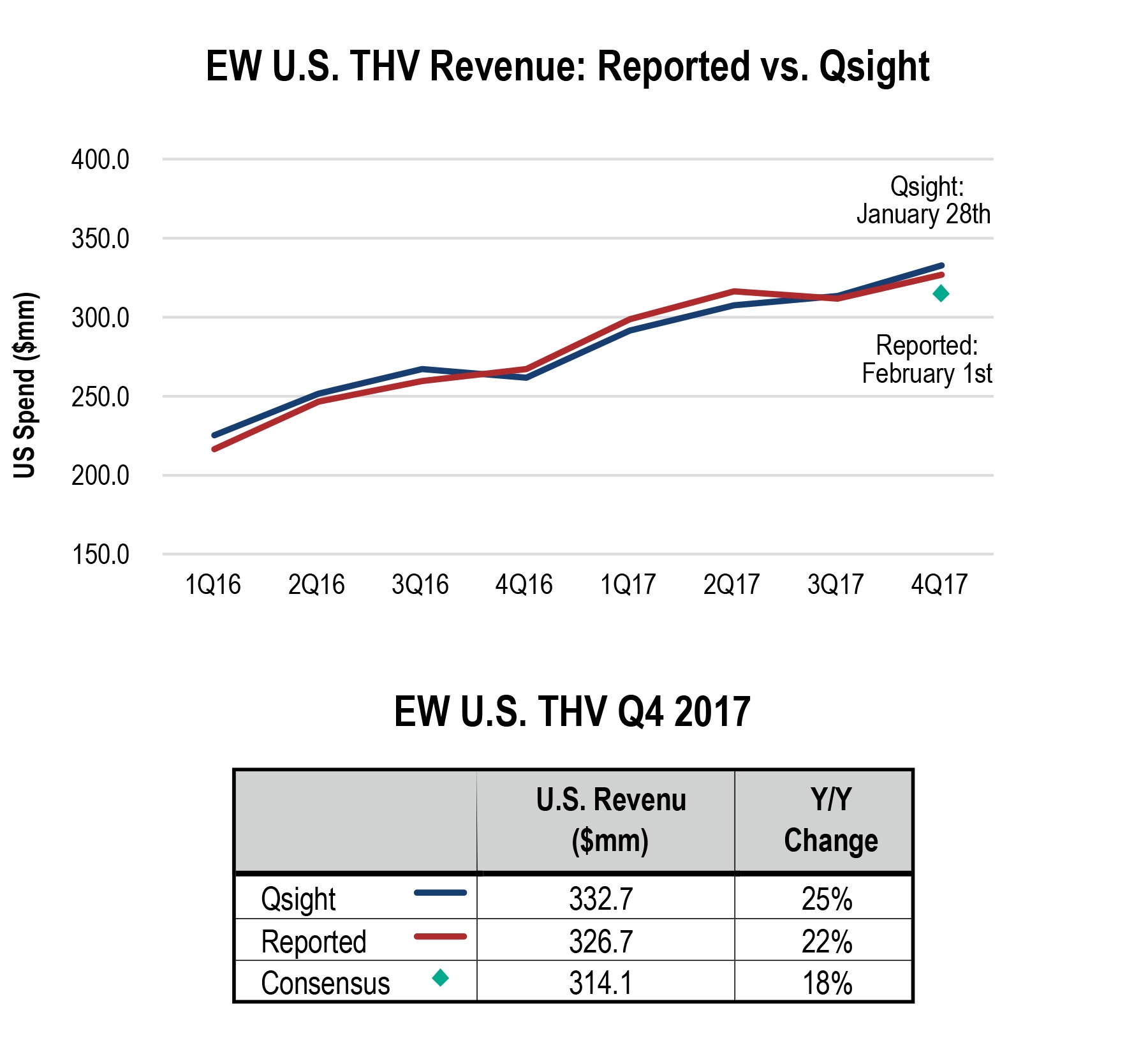

Guidepoint Qsight (Qsight) provides U.S. hospital purchasing data which tracks monthly purchasing of over 1,500 hospitals in near-real time. Prior to their earnings release, Qsight’s data and projection methodology showed potential Edwards’ Q4 2017 U.S. THV revenues much higher than Street estimates. Edwards’ Q4 2017 U.S. reported THV revenue outperformed Street expectations, sending the stock price surging over 6% in early market trading the following day.

Qsight’s monthly data can also provide timely indicators of the impact of Medtronic’s Evolut PRO and future competitive launches on Edwards’ U.S. THV market share. The chart below shows the historical impact of approvals for Medtronic’s CoreValve (1Q 2014), Evolut R (2Q 2015) and Evolut PRO (2Q 2017).

As an existing or potential shareholder in Edwards, why would you not want access to real-time data on its key products and market share?

About Guidepoint Qsight Healthcare

Guidepoint Qsight Healthcare provides a multi-dimensional, quantitative view that tracks company performance in the healthcare industry. By leveraging the power of proprietary industry data along with Guidepoint TRACKER’s primary data, Guidepoint can provide a level of insight into market dynamics not found anywhere else. With additional data added over time, this innovative new approach provides high-valued, coverage-driven insights for investment clients.

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. The information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.