Client Survey "Consultants' View on Expert Network Services"

As the Expert Network industry continues to impact how thousands of business decisions are made each day, our customers’ need for accurate, qualitative research continues to grow.

To understand how Expert Networks are being utilized in the current climate and to gain the knowledge necessary to improve our services, Guidepoint has surveyed Expert Network users from over 50 Consulting and Market Research firms across geographic regions, with job functions ranging from Junior Consultants to Principals and Partners, as well as Research / Knowledge Teams.

Guidepoint’s Client Survey was completed by more than one hundred users, offering a window into how Expert Networks could better bridge the gap between customer expectations and customer experience.

3. CONSULTANTS’ CRITERIA: RATING EXPERT NETWORKS

In our article on the Potential to Optimize Usage of Expert Networks, we identified several ways in which Consulting Firms could more proactively manage their Expert Network portfolio and improve work efficiency as a result. Provided the assessment of vendors remains a major opportunity for improvement, this section will focus on the criteria used by Consultants to rate Expert Networks.

OVERVIEW OF CRITERIA AND RANKING

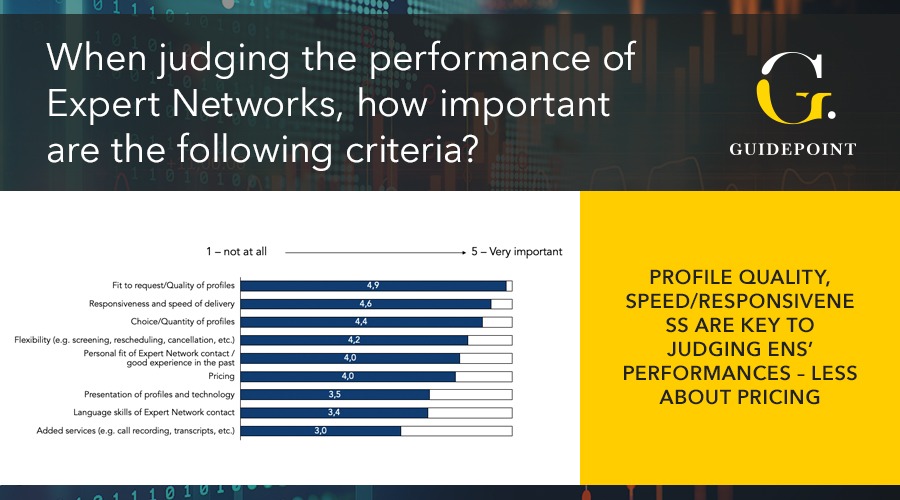

The indicators used to help Consultants evaluate the performance of Expert Networks were based on multiple judgment points, listed here from the most to least important:

1. Quality of profiles

2. Speed and Responsiveness

3. Quantity of profiles

4. Flexibility

5. Personal Fit of Expert Network contact

6. Pricing

7. Technology

8. Language skills

9. Added services

Perhaps it should come as no surprise that the quality of profiles (rated 4.9 out of 5) and responsiveness (rated 4.6 out of 5) are critical for most Consultants. When asked to indicate what Consulting Firms expect from Expert Networks moving forward, most respondents mentioned better network coverage, increased depth, and speed of delivery at the top of their list.

Likewise, the personal fit of Expert Network contact (rated 4.0 out of 5) is among the top five highest-rated criteria. This is particularly interesting to us, considering that Guidepoint’s primary focus has always been to develop close relationships with its clients and translate their feedback into actionable steps (e.g., actively discuss team setups to optimize performance, etc).

In the same context, pricing is less critical (rated 4.0 out of 5) than the quality of profiles (rated 4.9 out of 5), confirming that the value of specialized knowledge outweighs the costs associated with it.

Despite Consultants’ increasing demand for technological improvements (e.g., selecting/filtering expert profiles, ease of pre-arranging engagements), survey respondents have placed this criterion at the bottom of the list (rated 3.5 out of 5).

The same holds true for language capabilities offered by an Expert Network (rated 3.4 out of 5). The lack of interest in language skills can be attributed to the fact that most Consulting projects are managed in English. However, those who work on cases across multiple countries (e.g., Case Teams) can benefit the most here, since they often seek advice on international markets. Furthermore, sourcing expertise in the local language can help consultants uncover cultural aspects that would otherwise get lost in translation.

Compared to all the points listed earlier, added services (e.g., call recordings, call transcripts) seem to be the least relevant criteria for consultants (rated 3.0 out of 5).

While it appears that offering a broad range of services or technological updates can still be appealing to some, it will not compensate for any shortcomings in the most critical areas: quality of profiles and responsiveness.

“DEEP-DIVE”: FINDING THE RIGHT EXPERTS

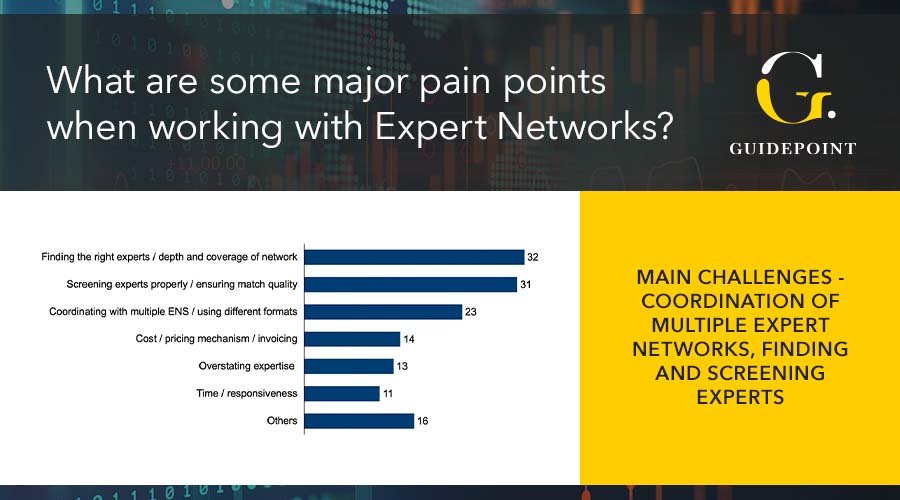

According to survey responses, it seems that finding suitable experts remains the primary interest for consultants. When asked to provide feedback on major pain points, most respondents reinforced existing findings, adding comments like ‘’adding more depth and coverage of network’’, ‘’screening the right experts’’ or ‘’ensuring quality/match’’.

However, the question remains: How does an Expert Network find the best experts? Interestingly enough, this brings us back to how Expert Networks actually operate. If we take Guidepoint as an example, Consultants will most likely be familiar with a two-pronged approach. For those who identify as first-time Expert Network users, this method consists of 1) sourcing within the existing portfolio of experts while simultaneously 2) custom recruiting new experts from outside based on specific criteria.

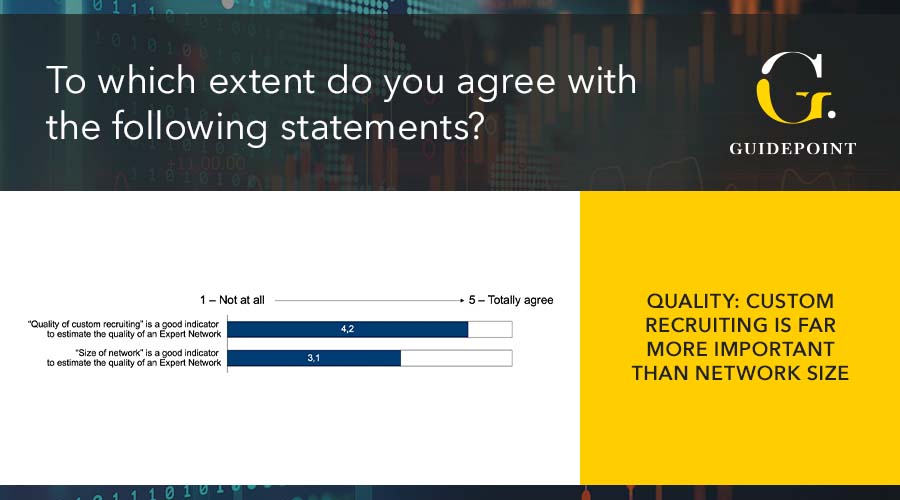

This custom-recruiting process is one of the primary ways experts become part of the network and, consequently, available for future requests. As a result, one would think that the ability to find the right experts is linked to the network size itself, the capacity to custom recruit, or both.

Against this background, respondents were asked to evaluate the importance of custom recruiting vs. network size. While the network size remains relatively significant (rated 3.1 out of 5), Consultants still prioritize the ability to custom recruit (rated 4.2 out of 5). Similar insights are reinforced by the fact that the ‘fit to request/quality of profiles’’ was rated higher (rated 4.9 out of 5) than the ‘’choice/quantity of profiles’’ (rated 4.4 out of 5).

Besides, consultants seem to believe in a future where specialization is key. More respondents see the value in industry-specialized networks (rated 4.1 out of 5) rather than in regional-specialized networks (rated 3.8 out of 5).

In this scenario, the need for customized Expert Network services becomes apparent. The number of projects researching niche markets has grown exponentially within the past years, and based on our experience, we expect it will only continue to increase.

“DEEP-DIVE”: SPEED AND RESPONSIVENESS

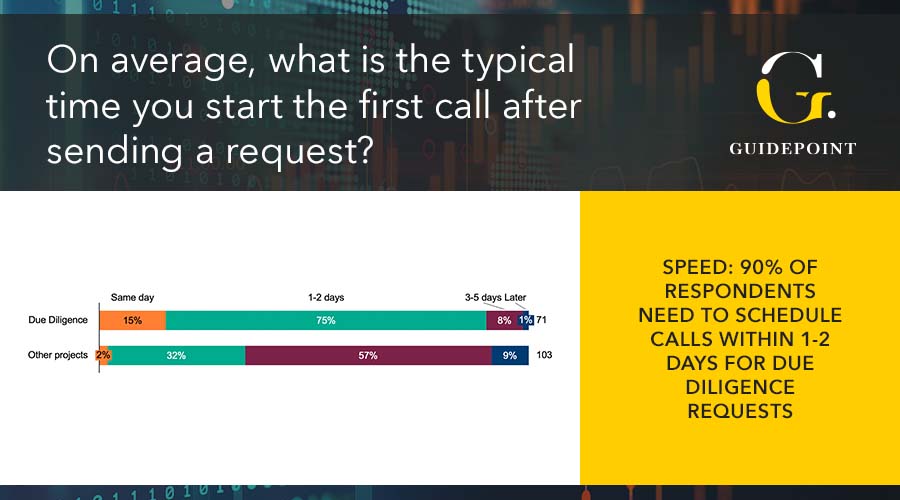

Given the urgency and pressing timelines associated with consulting projects, it is not entirely surprising to see that “responsiveness/speed of delivery” has been ranked as the second most important criteria (rated 4.6 out of 5) when evaluating Expert Networks.

Responsiveness is not judged only on how quickly the team can kick-off a new search with an Expert Network. Among other tasks, Consultants need to be able to inform on and respond to updates, notify on new project angles, and change country-focus — sometimes all at once. Speed of delivery, or rather speed of service, becomes crucial and is the exact reason why Consultants require Expert Networks to pick up the pace and meet their timely needs.

Similarly, when a consultant is time-pressured by a fast-approaching client update, the ideal scenario would be to receive the list of qualified expert profiles almost immediately and not after days of waiting.

This finding becomes more evident when we look at typical timelines for expert interview campaigns. On Due Diligence cases, 90% of respondents mention they start the first calls within two days, and 37% of respondents even end calls within just one week. Conversely, in other circumstances (e.g., Strategy cases), Consultants have more time to conduct expert interviews – with only 34% of respondents indicating a need for scheduling calls within two days.

Also, the preference for “quality and speed of delivery” is strongly emphasized by our respondents’ feedback on keeping (or not) certain Expert Network providers. Specifically, those who have recently added or removed an Expert Network from their portfolio have done so based on performance.

HOW RESPONDENTS RATE EXPERT NETWORK PROVIDERS

Based on our findings, Consultants see the most value in specialized Expert Networks; however, most respondents seem to be familiar with large incumbents and a few local players – with little to no feedback or mentions on other networks used.

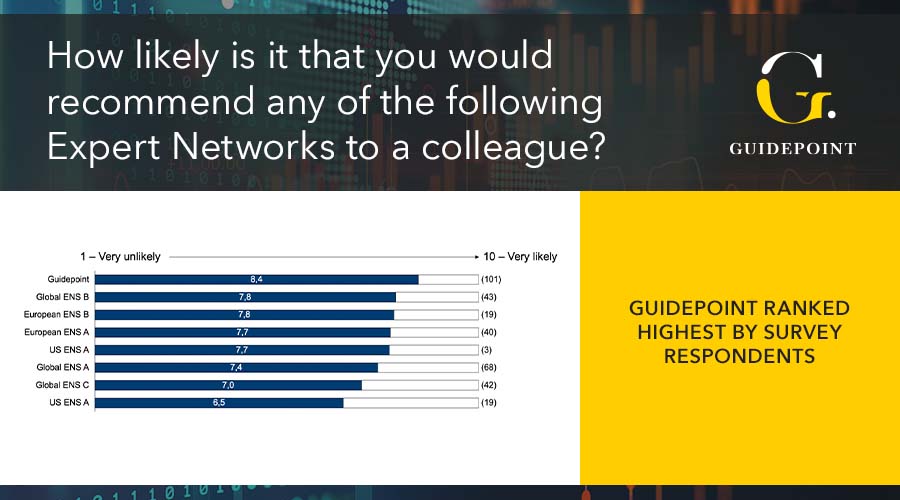

When asked to rate different Expert Network providers (global, regional, and local) based on how likely it is to recommend their services to a colleague, respondents chose to rate Guidepoint with a score of 8.4 out of 10. While we are pleased to note that this score represents the highest-ranking among the included vendors, we also gladly acknowledge that there remains room for improvement.

With 18 years of experience in covering our clients’ needs, we will continue to assess the Expert Network industry from a consultant’s perspective, accumulate the necessary knowledge to optimize our services and dedicate all our efforts to serving our growing client base.

Note: Provided this was Guidepoint’s first Global Survey on Consultants’ Expert Network usage, most of our participants are, in fact, consultants working with multiple Expert Network providers. Therefore, as the survey creator, the assessment and ranking of multiple vendors might slightly favor Guidepoint.

KEY FINDINGS

The value of getting the ‘right expertise’ comes first for consultants (rated 4.9 out of 5). Based on our findings, pricing does not outweigh the quality of Expert Network services.

Responsiveness was rated as the second most important criteria for consultants (rated 4.6 out of 5). Its impact and significance can be seen especially on Due Diligence cases.

Guidepoint obtained a net promoter score of 8.4 out of 10. On average, the score for other Expert Network providers was 7.6 out of 10.