Guidepoint Qsight Models: Medtronic Update

by Robert Conklin, Vice President of Sales, Guidepoint Data

With the addition of Medtronic (“MDT”) to our Guidepoint Qsight data-sets, we now have 16 company models available across the MedTech space. This timely data, gathered from over 2,000 medical facilities, offers clients new quantitative insights into Medtronic’s sales performance. We have updated our MDT projection results, which you will see below.

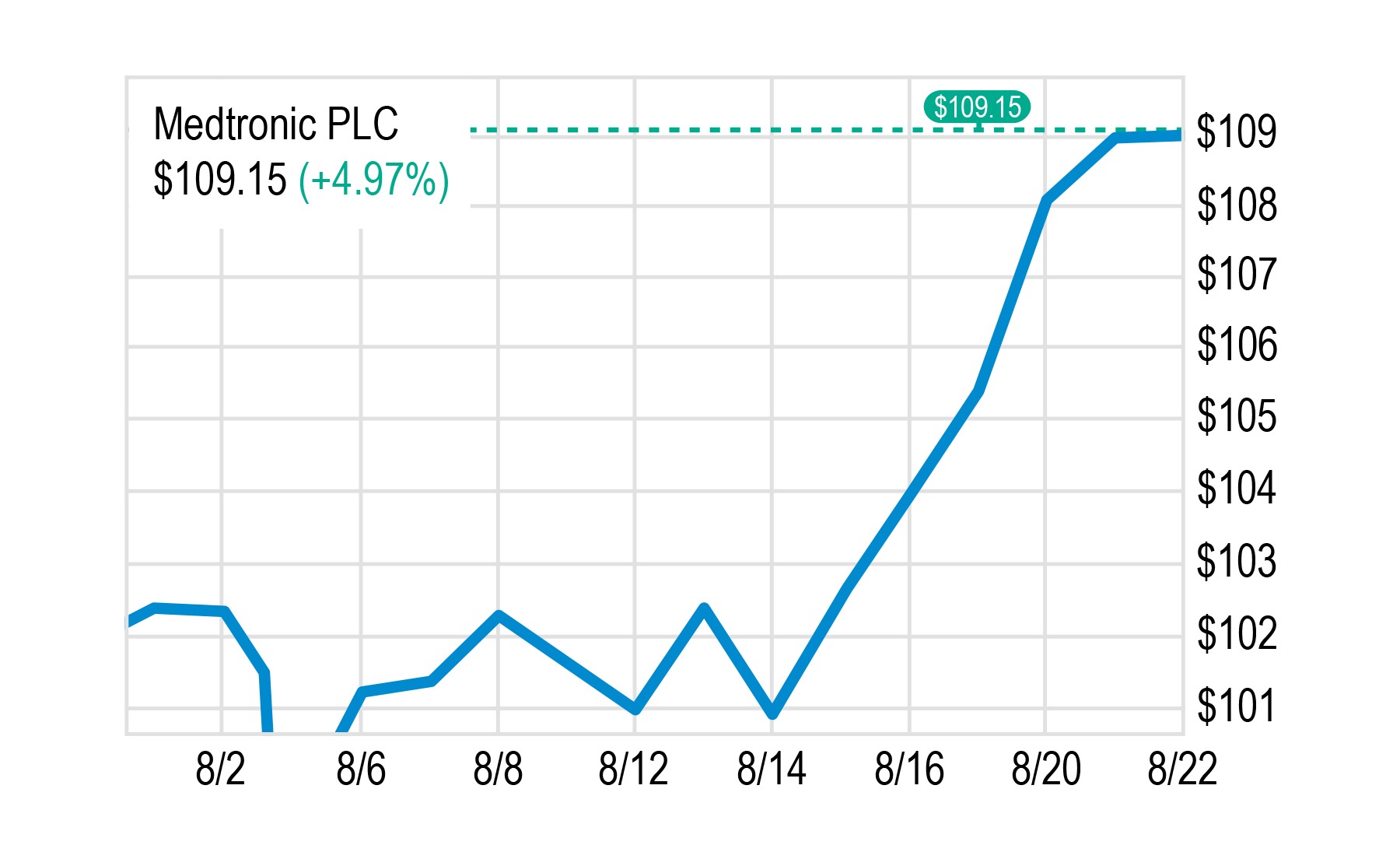

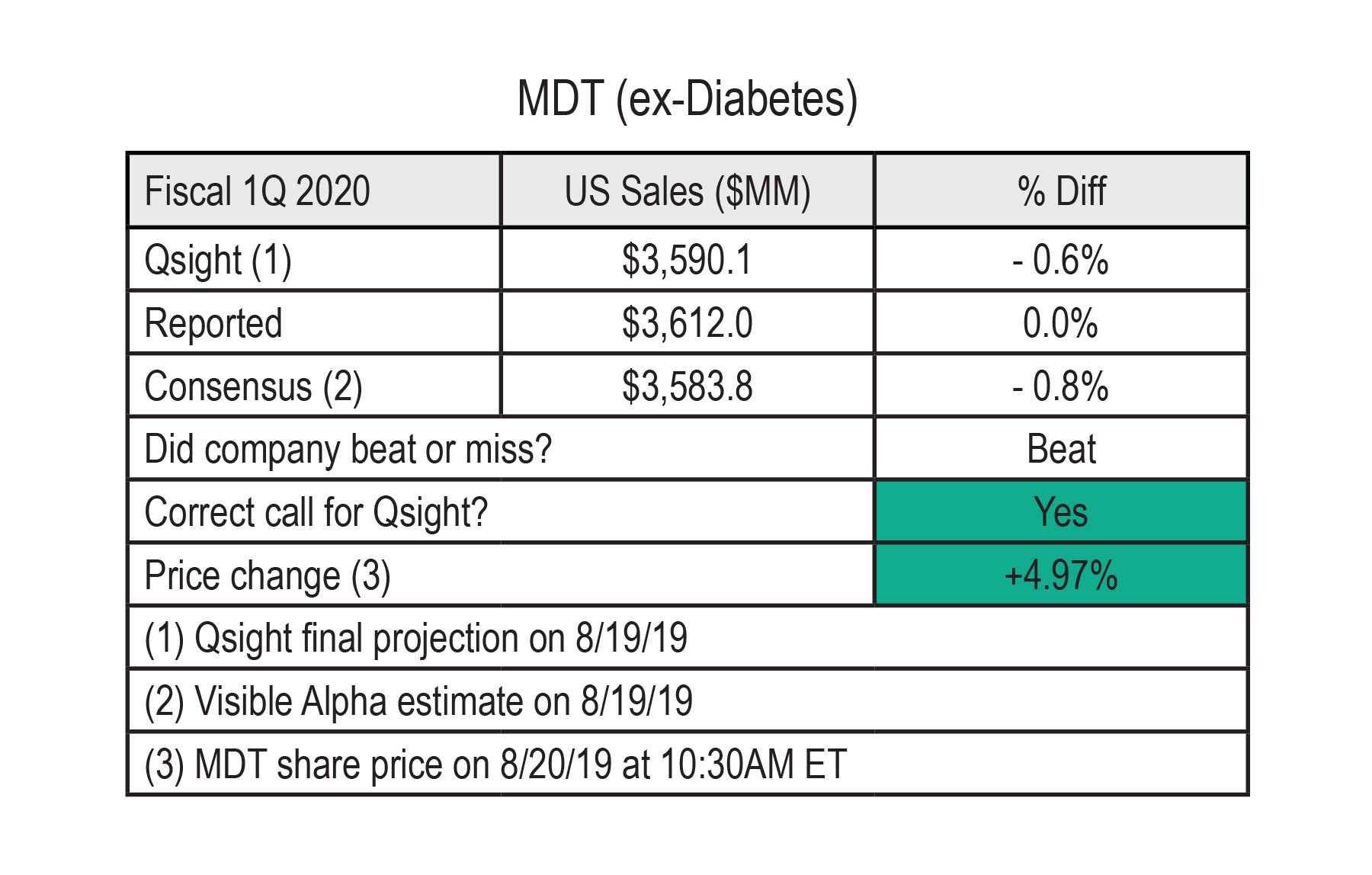

As you know, MDT reported their FY1Q20 earnings with U.S. sales coming in above sell-side consensus, which led to the stock opening up +4.97% as of 10:30AM ET last Tuesday, August 20th.

While sell-side estimates suggested MDT’s U.S. sales growth would be weaker than prior quarters, Qsight predicted a different story for 2Q19. Starting in July 2019, Qsight’s data and projection methodology began signaling potential strength with projected sales growth trending above consensus estimates. On August 19th, Qsight’s final projection for MDT implied a beat compared to consensus and proved to be accurate. See below for a recap:

We are excited by the continued validation of our Qsight data product. Please let us know if you would like to setup a demo or if you have any further questions.

AVAILABLE DATA-SETS

Updated on a weekly basis, Qsight currently offers easy-to-use Excel models with quarterly sales projections for the following companies:

Edwards Lifesciences (EW), Abiomed (ABMD), Penumbra (PEN), Intersect ENT (XENT), Wright Medical (WMGI), Zimmer Biomet (ZBH), Intuitive Surgical (ISRG), Smith & Nephew (SNN), Cardiovascular Systems (CSII), Atricure (ATRC), Boston Scientific (BSX), Stryker (SYK), Merit Medical (MMSI), CONMED (CNMD), SI-BONE (SIBN), Medtronic (MDT)

For a free demo of Qsight, please click below:

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. Any information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.