(NEW) Guidepoint Qsight Model: Medtronic

by Robert Conklin, Vice President of Sales, Guidepoint Data

With the addition of Medtronic (“MDT”) to our Guidepoint Qsight data-sets, we now have 16 company models available across the MedTech space. This timely data, gathered from over 1,500 hospitals, offers clients new quantitative insights into Medtronic’s sales performance.

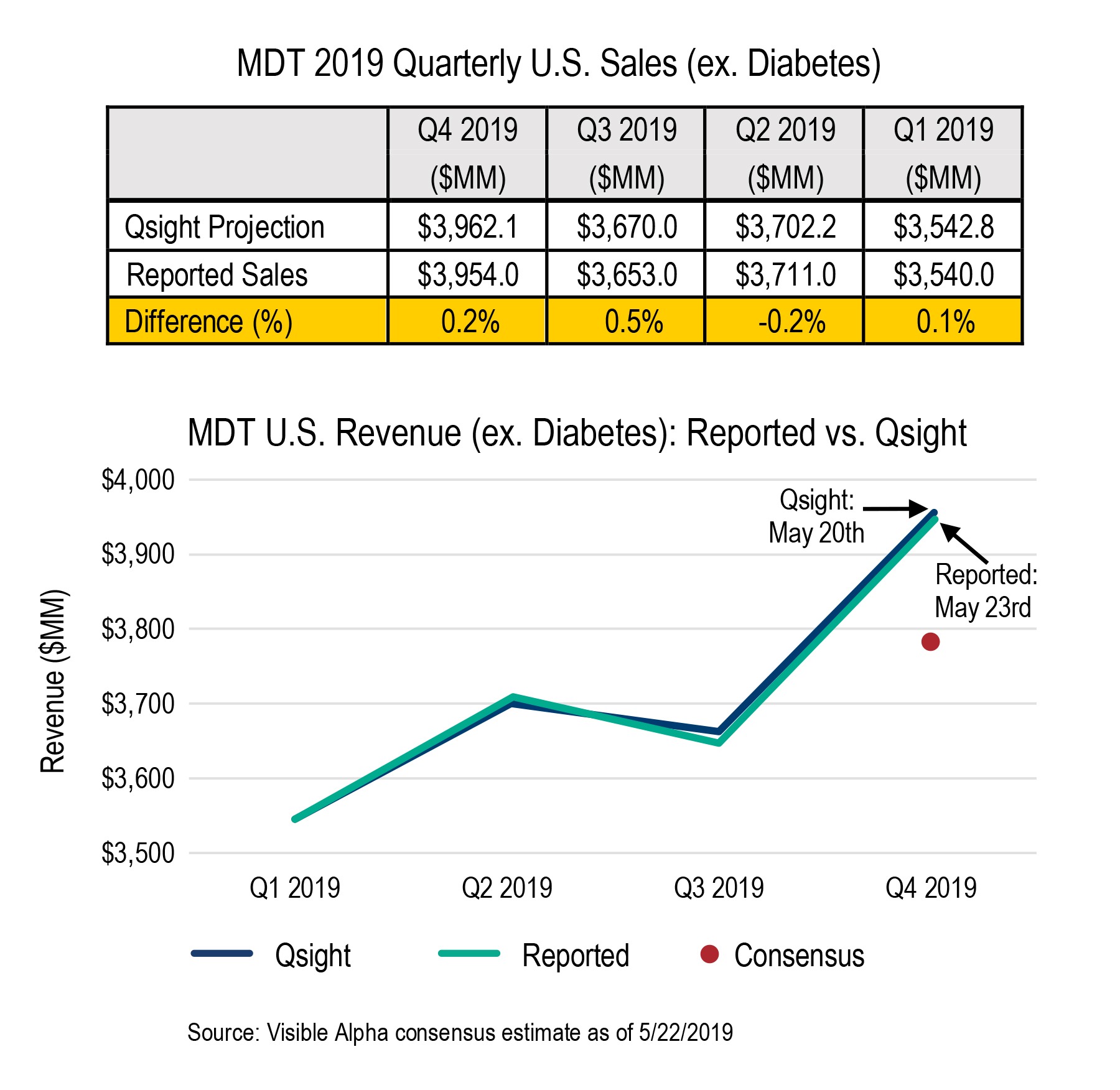

For MDT, Qsight projections have been consistently more accurate than Wall Street consensus across 5 of the past 6 quarters. In fact, leading up to MDT’s Q4 FY19 earnings release, Qsight’s data and projections showed potential for their U.S. revenue to come in above sell-side consensus estimates.

On May 23rd, MDT’s Q4 FY19 reported U.S. sales outperformed Street expectations, sending the stock price up +3% the next day. Below are Qsight’s sales projections, as compared to reported results:

AVAILABLE DATA-SETS

Updated on a weekly basis, Qsight currently offers easy-to-use Excel models with quarterly sales projections for the following companies:

Edwards Lifesciences (EW), Abiomed (ABMD), Penumbra (PEN), Intersect ENT (XENT), Wright Medical (WMGI), Zimmer Biomet (ZBH), Intuitive Surgical (ISRG), Smith & Nephew (SNN), Cardiovascular Systems (CSII), Atricure (ATRC), Boston Scientific (BSX), Stryker (SYK), Merit Medical (MMSI), CONMED (CNMD), SI-BONE (SIBN), NEW – Medtronic (MDT)

Guidepoint is not a registered investment adviser and cannot transact business as an investment adviser or give investment advice. Any information, analyses, forecasts, metrics, samples, estimated figures, trends, charts, tables, graphs, and projections contained herein or in any Guidepoint Data Product do not represent, contain or constitute investment advice and are not intended as an offer to sell or solicitation of an offer to buy any security, or as a recommendation to buy or sell any security and should not be relied upon as the basis for any transactions in securities.